First-time homebuyers often feel overwhelmed by the obstacles of the mortgage process. But don't fret! There are numerous programs designed specifically for first-timers, making your dream of homeownership a reality. One crucial step is understanding the various kinds of loans available.

A popular choice is the FHA loan, which requires a lower down payment and relaxed credit score requirements. Another option is the VA loan, exclusively for entitled veterans, offering favorable interest rates and zero down payment. Conventional loans are also obtainable to first-time buyers with good credit and a larger down payment.

To ensure you find the best fit for your financial situation, it's essential to consult a mortgage lender. They can guide you through the application and help you understand the terms of each loan type. Remember, owning a home is a significant commitment, so take your time, do your research, and don't hesitate to ask questions.

Exciting Advantages for New Homeowners

Purchasing your initial home is an significant decision, and it's normal to feel a mix of excitement. Thankfully, there are many benefits designed specifically for first-time buyers. These programs and incentives can help make your dream of owning a first time home buyer reality by minimizing costs and expediting the process.

One of the most common benefits is access to competitive mortgage rates. Financial incentives can also help with down payments, closing costs, and even monthly housing expenses. Don't neglect these valuable resources that are available to you!

Whether you're hunting for a cozy townhouse or your dream single-family home, taking advantage of these benefits can give you a powerful boost.

Embarking on the Market: The First Time Home Owner Loan Process

Purchasing your first home is a monumental milestone, filled with both excitement and complexity. The loan process can seem daunting, especially for newcomers. To effectively manage this journey, it's crucial to grasp the steps involved and funding options.

One of the initial steps is to evaluate your budget. This involves analyzing your income, expenses, and existing liabilities. Next, you'll want to explore different loan programs that suit your needs.

Remember to thoroughly scrutinize interest rates, conditions, and lender track records. A qualified mortgage lender can provide valuable support throughout the entire procurement process.

Gaining Your First Home: Financing Tips for Buyers

Securing your first home is a major milestone, but the financing process can seem daunting. Don't stress, understanding the fundamentals about mortgages and exploring available options can make all the difference.

First assessing your financial position. Determine your debt-to-income ratio, review your spending habits, and calculate a realistic budget that factors down payment contributions and monthly mortgage payments.

Next, compare different lenders to obtain the best interest rates and loan terms. Avoid settling for the first offer you get. Take the time to comprehend the intricacies of each mortgage option before making a decision.

Finally that owning a home is a long-term purchase. Be ready to make monthly payments consistently and care for your property to increase its value over time.

Unlocking Your Dream: First-Time Home Buyer Programs Explained

Embarking on the journey of homeownership is an exciting milestone, and for first-time buyers, navigating the process can seem daunting. Fortunately, numerous programs are designed specifically/tailored/exclusively to assist/support/aid aspiring homeowners in making their dreams a reality. These initiatives offer various benefits, including mortgage loan guarantees, making homeownership more accessible and affordable.

Understanding these programs is crucial for first-time buyers looking for leverage these valuable resources. By exploring the available options, potential homeowners can identify/discover/ pinpoint the ideal programs that align/match/correspond with their individual needs and financial situations.

- Some/Numerous/Several popular first-time home buyer programs include:

- USDA loans

- Regional homeownership grants

It is essential for first-time buyers to conduct/perform/undertake thorough research and consult/speak with/engage a qualified mortgage lender or housing counselor. They can provide valuable guidance/advice/support in navigating the complexities of the home buying process and helping/assisting/guiding you toward your dream home.

Step into Your Dream

Taking the plunge into homeownership can appear overwhelming. But with a little preparation and guidance, it can turn into a rewarding experience. This simple guide is here to equip you navigating the process efficiently as a first-time homebuyer.

First things first, determine your budget. Consider your income, outgoings, and savings. Getting pre-approved for a mortgage will give you a clear understanding of what you can purchase.

- Research neighborhoods that meet your needs.

- Connect with a realtor who can guide you through the process and support you in discovering the perfect property.

- Make informed decisions on properties, neighborhoods, and the overall real estate market.

{Remember, buying a home is a significant investment.|It's a major milestone in your life. |This process takes time and patience.| Don't rush into anything.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Christina Ricci Then & Now!

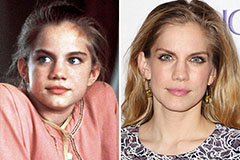

Christina Ricci Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!